featured insight

featured insight

Optimism Plunges Among Minnesota Manufacturing Executives

The latest annual study conducted by Meeting Street Insights on behalf of Enterprise Minnesota shows deep concerns among manufacturing executives.

Every year, Meeting Street Insights conducts a State of Manufacturing survey for Enterprise Minnesota. Hundreds of manufacturing executives in the state, including owners, CEOs, CFOs, COOs, presidents, vice presidents, and managing officers share their observations about their companies and the overall economy.

This year, the long shadow of the COVID-19 economy is apparent in every question. 2020 has triggered the greatest plunge in optimism among manufacturers since the Great Recession of 2008, the year that Enterprise Minnesota launched its State of Manufacturing study. The number of companies expecting increased revenues has never been lower, and the number of executives who fear recession increased seven-fold in 2020. Confidence in the business climate has fallen to half what it was in 2018.

Keep reading to learn more about the concerns of these executives and how COVID-19 is impacting their businesses and plans.

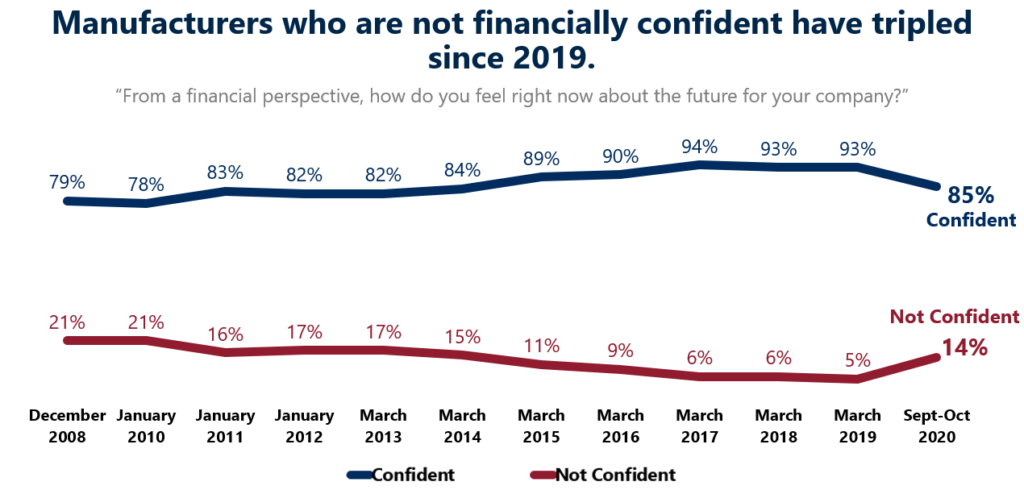

Manufacturers are becoming less confident in the futures of their companies

While 85% of manufacturing executives remain confident in their company’s future, the number dropped sharply in 2020 from the high 93%-94% who reported in between 2017 and 2019. Simultaneously, the percentage of executives who say they are “not confident” rose sharply, tripling from the low of 5% in 2019 to 14% in 2020.

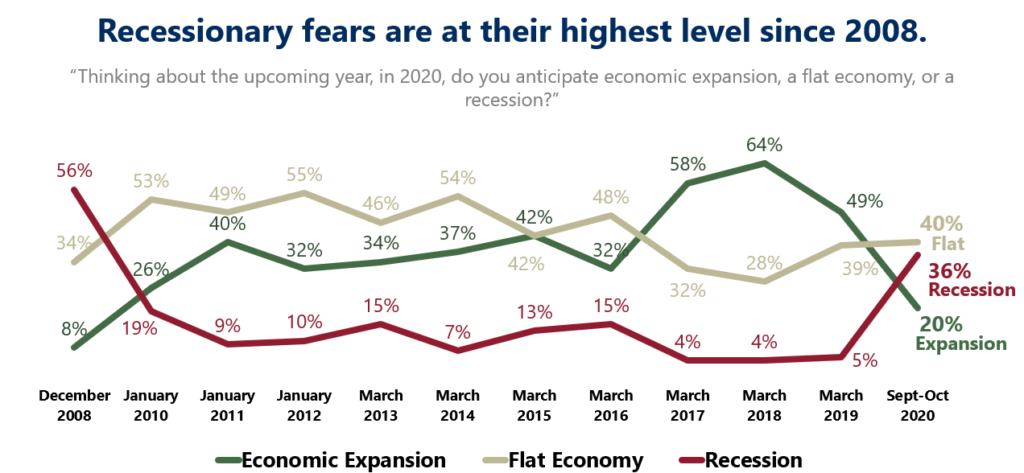

Fears of a recession are high

In addition to the increased concern about their companies’ financial future, 36% of executives are anticipating a recession in the rest of 2020 and 40% think the economy will remain flat. Only 20% think there will be an expansion, which is a steep decline from the high of 64% who were expecting expansion in March of 2018.

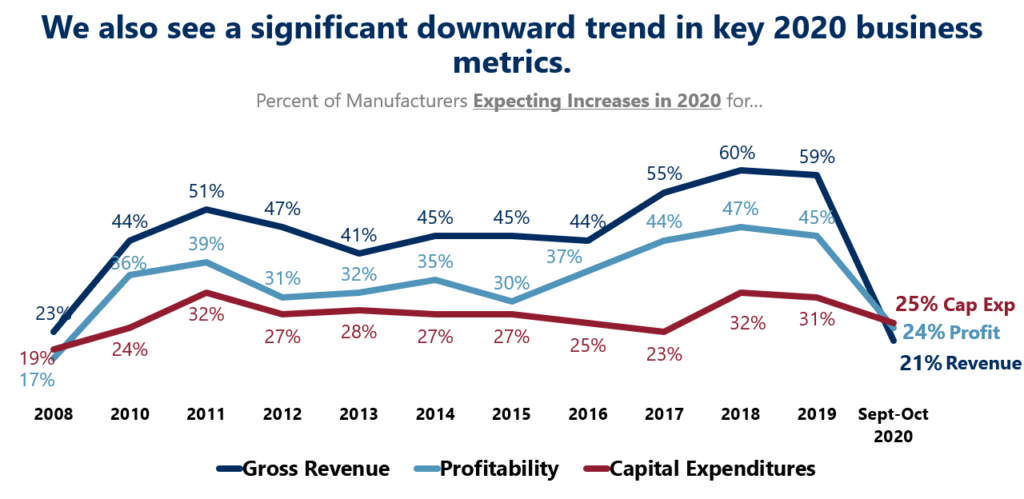

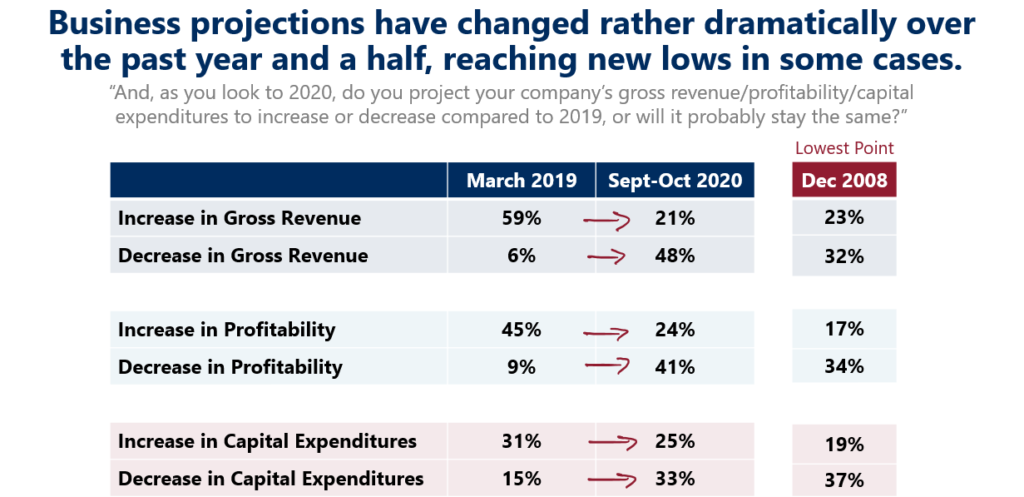

Concerns extend to key business metrics

Executives aren’t expecting key metrics to improve in 2020. The percentage of executives who anticipate increases in revenue, profit, and capital expenditures are among the lowest since the first State of Manufacturing study in 2008.

While 59% of executives expected to increase revenue in 2019, only 21% said the same in 2020. The expected dip in profitability was sharp as well, decreasing from 45% to 24%.

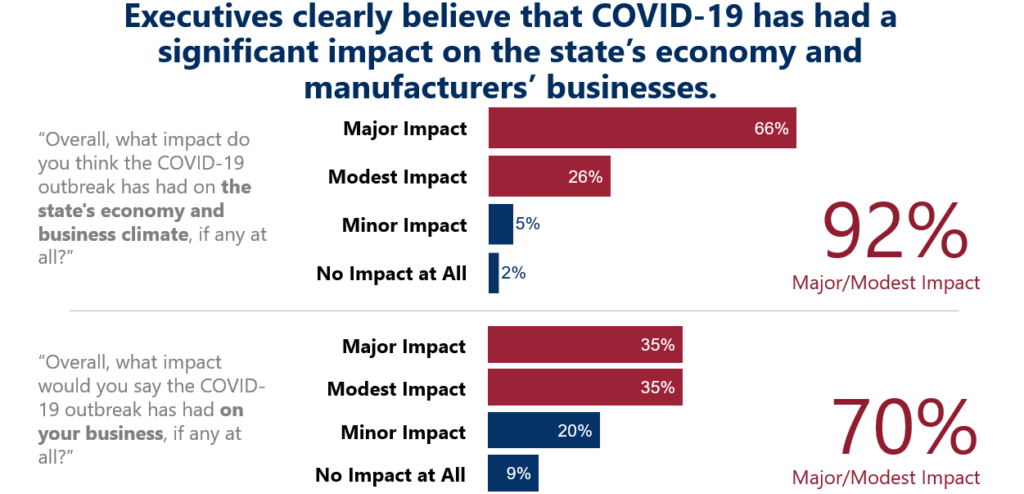

Executives believe COVID-19 has seriously impacted the state’s economy and their businesses

There is broad agreement that the pandemic has impacted individual businesses and the economy as a whole. Sixty-six percent of executives report that COVID-19 has had a major impact on Minnesota’s economy and overall business climate. Another 26% believe it’s had a modest impact.

Looking inward, three in four executives reported that COVID-19 has had an impact on their businesses, split between 35% reporting a major impact and 35% a modest one.

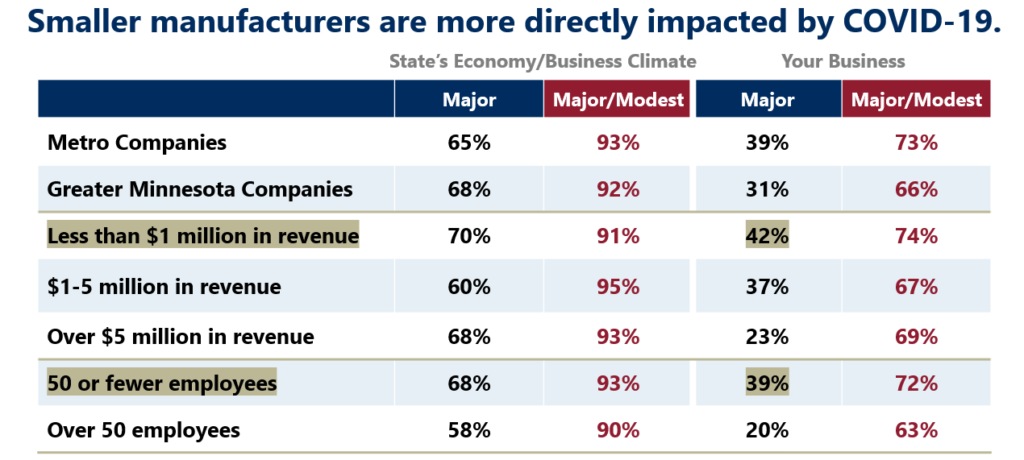

Smaller manufacturing companies report more impact from COVID-19 than larger companies

Among companies making less than $1 million, 42% report that COVID-19 had a major impact on their business. The percentage remains relatively high for companies earning between $1 million and $5 million—with 37% reporting major impacts. Executives in companies making over $5 million in revenue are the least likely to report a major negative impact (23%).

The gap is more pronounced when companies are divided by their number of employees. Thirty-nine percent of companies with fewer than 50 employees said that COVID-19 had a major impact on their business, while only 20% of companies with more than 50 employees said the same.

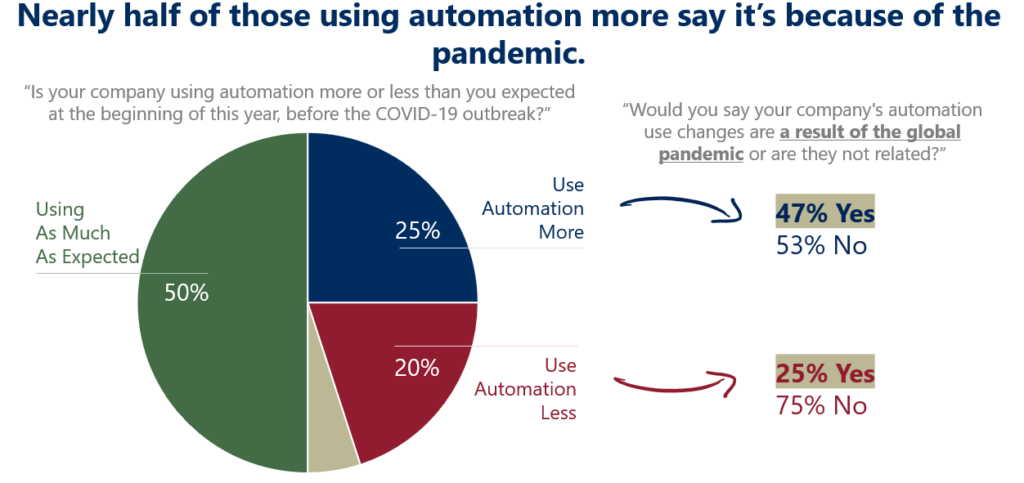

COVID-19 is driving slightly increased automation in the industry

One in four manufacturing executives are using more automation than they expected at the beginning of the year, before the COVID-19 outbreak. Of those, 47% said the increased use was a result of the pandemic. One in five executives are using automation less in their processes. The difference here is that only 25% of those say it is because of the pandemic.

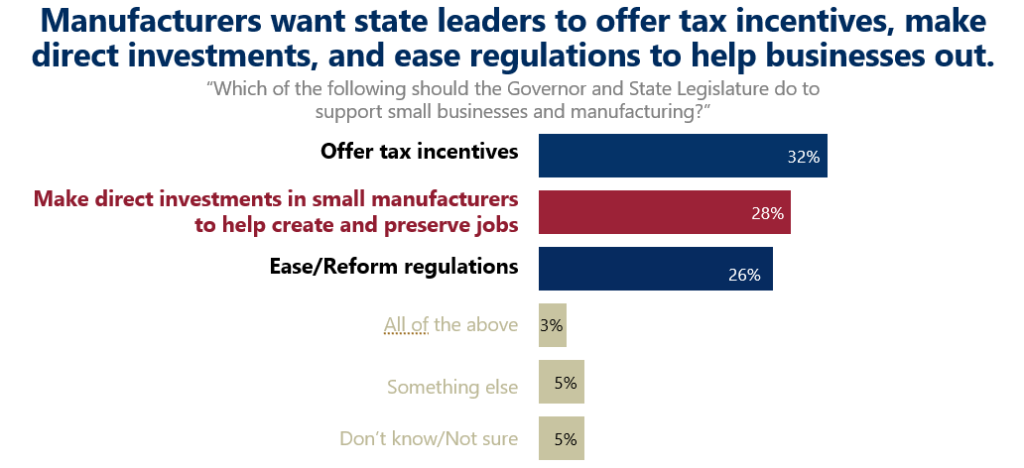

Manufacturers are looking for state-level support

Manufacturing executives want help from state leaders. 32% of executives are looking for tax incentives, 28% would like direct investments, and 26% would like to ease or reform regulations.

Fewer executives feel confident about the future of their companies, profitability, and revenue than in previous years. In many cases, these numbers are as bleak as they were during the Great Recession of 2008. It’s clear that COVID-19 has caused large-scale changes across the manufacturing industry, and executives are looking for state support to safeguard the future of their companies.

Meeting Street Insights conducted this survey September 8 – October 7, 2020, among 400 manufacturing executives. It has a margin of error of +4.9%. Respondent titles included owners, CEOs, CFOs, COOs, presidents, vice presidents, and managing officers.

What do you need to know? We can help. Get in touch or subscribe to our newsletter.